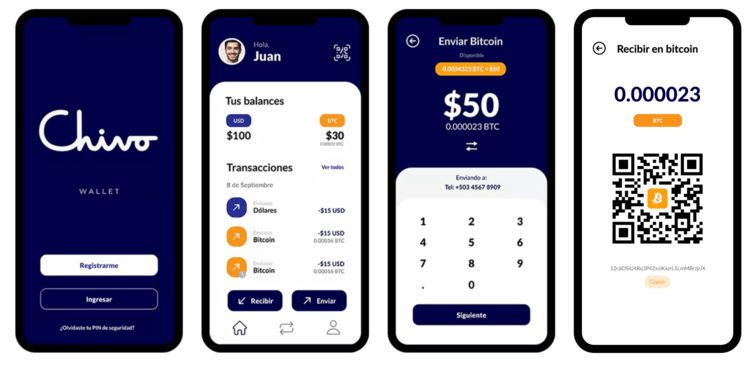

A damning new report suggests use of the Chivo wallet has plummeted in El Salvador.

The U.S. National Bureau for Economic Research notes there was a flurry of downloads after President Nayib Bukele said every Salvadoran citizen could claim $30 in free Bitcoin if they downloaded the app.

But a survey of 1,800 households has revealed that just 40% of those who installed Chivo have continued to use it after spending their Bitcoin.

The research also suggests that “virtually no downloads” of this app have taken place in 2022 — with a sizable number of Salvadorans reluctant to give Chivo a try because they prefer cash and don’t trust Bitcoin.

Even more worryingly, there’s little evidence that Chivo is being used to pay taxes or send remittances “at a significant scale” — with El Salvador’s central bank conceding that just 1.6% of remittances went through digital wallets in February 2022.

Remittances were touted as a major use case for Chivo, not least because they could reduce the fees that are charged when funds are sent by foreign workers back home to their loved ones.

A Long Way to Go

El Salvador adopted Bitcoin as legal tender back in September 2021 — and eight months on, the report claims that just 20% of businesses in the country accept this cryptocurrency as a means of payment.

Firms that do so are likely to be large ones — think McDonald’s and Starbucks — and overall, it’s estimated that only 4.9% of all sales in the country have been paid using BTC.

Even among the businesses that have received Bitcoin, 88% of them opted to convert the funds to dollars rather than keep the BTC in their Chivo wallet. The report added:

“Overall, despite the legal tender status of bitcoin and the large incentives implemented by the government, the cryptocurrency is largely not an accepted medium of exchange in El Salvador.”

The gloomy report could prove ominous — not least because the Central African Republic has just become the second country in the world to adopt Bitcoin as legal tender.

Critics have argued that El Salvador enforced its Bitcoin Law too quickly, elevating the cryptocurrency to the same status as the U.S. dollar in just three months. This sparked widespread protests across the country.

President Nayib Bukele has regularly invested public funds into BTC, but the country is currently nursing millions of dollars in paper losses — and the cryptocurrency has plummeted by 25% since Sept. 7.

The president’s announcements of new Bitcoin buys have stopped in recent weeks — and ambitions to raise $1 billion through so-called “volcano bonds” have also been thrown into doubt.

The launch of the bonds, which aims to raise funds to buy more BTC and build infrastructure for mining, has been repeatedly delayed — and some economists claim this is a sign that there’s a lack of interest among investors.

El Salvador is currently in a state of emergency following a spike in gang-related killings.